WWE made a new SEC filing today (January 17, 2023), stating that, as of yesterday, Vince McMahon no longer needs stockholders’ approval for his actions.

The filing reads as follows:

Introductory Note

On January 5, 2023, Vincent K. McMahon, the controlling stockholder of World Wrestling Entertainment, Inc. (the “Company”), executed and delivered a written consent (the “January 5th Consent”) taking certain actions by consent without a meeting in accordance with Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) resulting in, among other things, the election of Mr. McMahon to the Board of Directors of the Company (the “Board”) and certain amendments to the Company’s bylaws (the “January 5th Amendments”) that Mr. McMahon indicated were intended to ensure that the Company’s corporate governance continued to properly enable and support stockholder rights. On January 6, 2023, the Company issued a press release providing an update regarding the composition of its Board, including Mr. McMahon’s return to the Board, and the Company’s intention to explore strategic alternatives with the goal to maximize value for all stockholders of the Company. On January 9, 2023, the Board elected Mr. McMahon as Executive Chairman of the Board.

Subsequently, Mr. McMahon informed the Company of his view that there is substantial alignment among the Board and management concerning the decision to conduct a review of strategic alternatives amid the Company’s upcoming media rights cycle and that the Company’s corporate governance will properly enable and support stockholder rights. In light of the foregoing, on January 16, 2023, Mr. McMahon, in his capacity as controlling stockholder of the Company, executed and delivered a written consent (the “January 16th Consent”) taking certain actions by consent without a meeting in accordance with Section 228 of the DGCL to substantially repeal the January 5th Amendments, as further described below in Item 5.03.

No further approval of the stockholders of the Company is required to approve any of the actions taken by Mr. McMahon pursuant to the January 16th Consent. Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company expects to file with the SEC, and thereafter mail to its stockholders, an information statement as required by Schedule 14C promulgated under the Exchange Act to provide stockholders with information concerning the January 5th Consent and January 16th Consent. The Schedule 14C will also constitute notice to stockholders in accordance with Section 228 of the DGCL of the actions taken by the January 5th Consent and the January 16th Consent.

Item 5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

Effective January 16, 2023, pursuant to the January 16th Consent, Mr. McMahon repealed all of the January 5th Amendments (which were incorporated into the amended and restated bylaws of the Company filed with the SEC on January 11, 2023 as Exhibit 3.1 to the Company’s Current Report on Form 8-K) other than Article XI (Exclusive Forum), which designates (i) the Court of Chancery of the State of Delaware, to the fullest extent permitted by law, as the sole and exclusive forum for the resolution of, among other claims, any derivative action or proceeding brought on behalf of the Company, and (ii) the federal courts of the United States of America, to the fullest extent permitted by law, as the sole and exclusive forum for any cause of action arising under the Securities Act of 1933, as amended (the Company’s bylaws, as amended and restated as a result of the January 16th Consent, are referred to as the “Amended and Restated By-Laws”).

The foregoing summary of the Amended and Restated By-Laws is a summary and does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended and Restated By-Laws, which are attached as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.07

Submission of Matters to a Vote of Security Holders.

The information set forth in the Introductory Note and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.07.

You can read the full filing at this link.

There’s also a separate filing that states McMahon has repealed all of the amendments that were made on January 5.

That feeling reads as follows:

On January 5, 2023, the Reporting Person, the controlling stockholder of the Issuer, executed and delivered a written consent (the “January 5th Consent”) taking certain actions by consent without a meeting in accordance with Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) resulting in, among other things, the election of the Reporting Person to the Board and certain amendments to the Issuer’s bylaws (the “January 5th Amendments”) intended to ensure that the Issuer’s corporate governance continued to properly enable and support stockholder rights. On January 6, 2023, the Issuer issued a press release providing an update regarding the composition of its Board, including the Reporting Person’s return to the Board, and the Issuer’s intention to explore strategic alternatives with the goal to maximize value for all stockholders of the Issuer. On January 9, 2023, the Board elected the Reporting Person as Executive Chairman of the Board.

Subsequently, the Reporting Person informed the Issuer of his view that there is substantial alignment among the Board and management concerning the decision to conduct a review of strategic alternatives amid the Issuer’s upcoming media rights cycle and that the Issuer’s corporate governance will properly enable and support stockholder rights. In light of the foregoing, on January 16, 2023, the Reporting Person, in his capacity as controlling stockholder of the Issuer, executed and delivered a written consent (the “January 16th Consent”) taking certain actions by consent without a meeting in accordance with Section 228 of the DGCL to substantially repeal the January 5th Amendments, as further described below.

Effective January 16, 2023, pursuant to the January 16th Consent, the Reporting Person repealed all of the January 5th Amendments (which were incorporated into the amended and restated bylaws of the Issuer filed by the Issuer with the Securities and Exchange Commission on January 11, 2023 as Exhibit 3.1 to the Issuer’s Current Report on Form 8-K) other than Article XI (Exclusive Forum), which designates (i) the Court of Chancery of the State of Delaware, to the fullest extent permitted by law, as the sole and exclusive forum for the resolution of, among other claims, any derivative action or proceeding brought on behalf of the Issuer, and (ii) the federal courts of the United States of America, to the fullest extent permitted by law, as the sole and exclusive forum for any cause of action arising under the Securities Act of 1933, as amended.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the January 16th Consent filed as Exhibit 99.1 hereto, which is incorporated by reference in its entirety into this Item 4.

The Reporting Person intends to participate in and influence the affairs of the Issuer, including with respect to the matters discussed above, through the exercise of his voting rights with respect to his shares of Class A Common Stock and Class B Common Stock. The Reporting Person currently controls approximately 81.0% of the Issuer’s total voting power.

The Reporting Person may purchase additional shares of Class A Common Stock or Class B Common Stock or similar securities from time to time, either in brokerage transactions in the over-the-counter market or in privately-negotiated transactions. Any decision by the Reporting Person to increase his holdings of Class A Common Stock or Class B Common Stock will depend on various factors, including, but not limited to, the price of the shares of Class A Common Stock, the terms and conditions of the transaction and prevailing market conditions.

The Reporting Person also may, at any time, subject to compliance with applicable securities laws, dispose of some or all of his Class A Common Stock and/or Class B Common Stock or enter into additional variable forward sale contracts or other monetization transactions, depending on various factors, including, but not limited to, the price of the shares of the Class A Common Stock, the terms and conditions of the transaction and prevailing market conditions, as well as liquidity, family planning and diversification objectives. In addition, the Reporting Person may from time to time pledge all or part of his Class A Common Stock and/or Class B Common Stock to one or more banking institutions or brokerage firms as collateral for loans made by such entities to the Reporting Person or his affiliates or controlled entities.

The Reporting Person does not have any current plan or proposal other than as described herein, including in relation to facilitating the Issuer’s review of strategic alternatives and upcoming media rights negotiations, or has been publicly disclosed by the Issuer that relates to or would result in any of the transactions or other matters specified in clauses (a) through (j) of Item 4 of Schedule 13D. The Reporting Person may, at any time and from time to time, review or reconsider his position and/or change his purpose and/or formulate plans or proposals with respect thereto.

You can read that filing in full at this link.

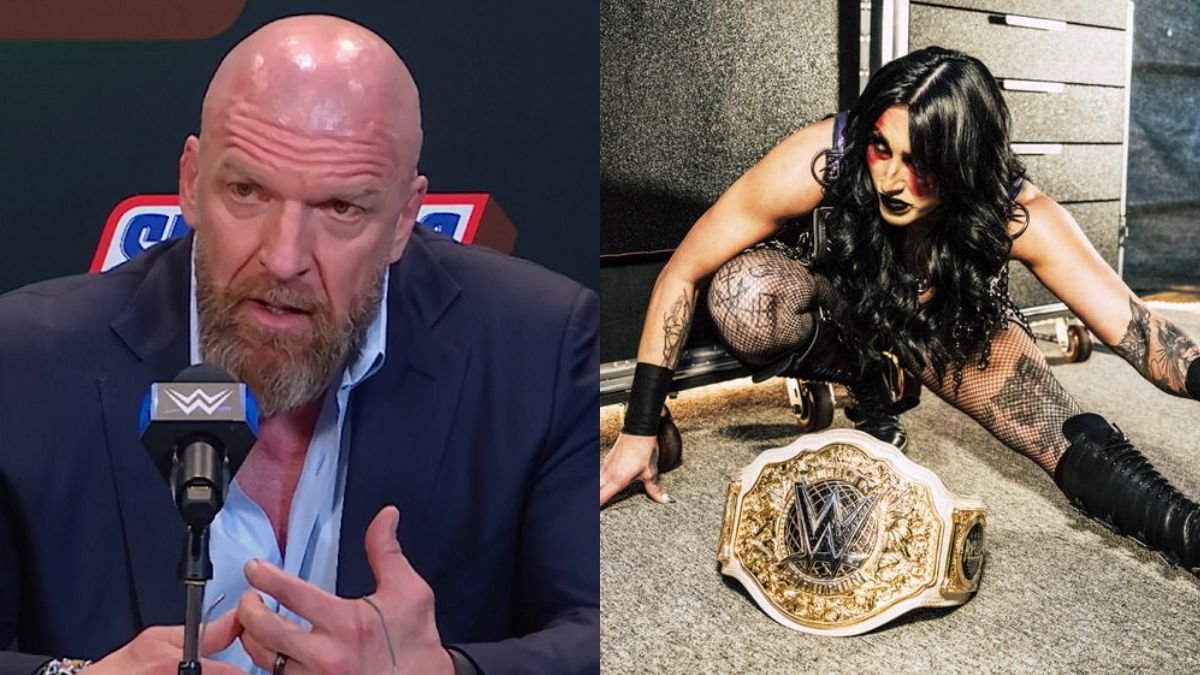

Paul Levesque (Triple H) told WWE talent in a meeting before SmackDown on January 13 and before Raw on January 16 that nothing would change on the creative side of things and he would still be the person heading that up.

He did say he and McMahon “may have discussions”, but Levesque is the one making final decisions.

However, it’s worth remembering that WWE did hold a meeting with employees (not talent) a week earlier and the message was “business as usual” and that no management would be changing, and then Stephanie McMahon resigned just days later, so it seems even what’s being said in the meetings is a fluid situation and things may change.

On January 6, using his power as majority owner, Vince McMahon put himself and former WWE presidents George Barrios and Michelle Wilson back on the company’s Board of Directors, disposing of JoEllen Lyons Dillon, Jeffrey R Speed, and Alan M Wexler in the process.

McMahon had stated that his intention was to facilitate a sale of the company.

He changed bylaws to ensure that no sale or media rights deal could be completed without his approval.

Upon McMahon’s return, two further Board members resigned of their own volition, those being Man Jit Singh – who was the one heading up the Board’s investigation into McMahon – and Ignace Lahoud.

Stephanie McMahon then resigned from her role as co-CEO and Chairwoman and her position on the Board on January 10, as Vince McMahon was elected Executive Chairman.

On January 15, Dave Meltzer of the Wrestling Observer reported that Vince McMahon was back in his office and had been “suggesting changes” to different departments.

On January 17, WWE made a new SEC filing stating that, as of January 16, Vince McMahon no longer needs stockholders’ approval for his actions.

There has been much speculation that Vince McMahon was looking to sell to a party that would commit to keeping him in charge of the company despite the multiple sexual assault allegations that have surfaced in the past year that led to his initial ‘retirement’ in July.

You can keep up with all the latest news and updates on a potential WWE sale by clicking here.

Think you’re a wrestling mastermind? Well you can prove it by taking quizzes in our brand new quiz section! Don’t forget to tweet us your results!

Trending

- Two Free Agents Potentially Joining AEW Update

- Former WWE Champion & More Released By The Company

- Former WWE Star Expected To Be Returning To The Company

- Planned Members For New WWE Faction Confirmed

- Seth Rollins Spotted For First Time Since WWE WrestleMania 40

- WWE Star Teases Leaving With Championship

- WWE Star Responds To Character Being Called A ‘Waste Of Time’

- Real-Life WWE Couple React To Criticism

- Another Surprising Challenger For WWE World Heavyweight Championship Revealed

- Major WWE Star Undergoes Surgery

mailing list

mailing list